| diagram |  |

||||

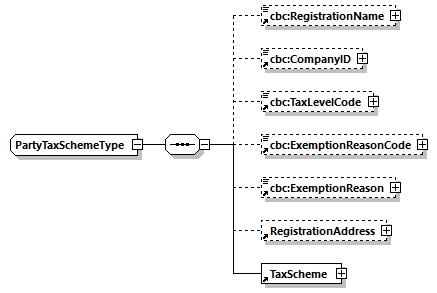

| namespace | urn:dgpe:names:draft:codice:schema:xsd:CommonAggregateComponents-2 | ||||

| children | RegistrationName CompanyID TaxLevelCode ExemptionReasonCode ExemptionReason RegistrationAddress TaxScheme | ||||

| used by |

|

||||

| annotation |

|

||||

| source | <xsd:complexType name="PartyTaxSchemeType"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>ABIE</ccts:ComponentType> <ccts:DictionaryEntryName>Party Tax Scheme. Details</ccts:DictionaryEntryName> <ccts:Definition>Information about a party's Tax Scheme.</ccts:Definition> <ccts:ObjectClass>Party Tax Scheme</ccts:ObjectClass> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>ABIE</ccts:ComponentType> <ccts:DictionaryEntryName>Party Tax Scheme. Details</ccts:DictionaryEntryName> <ccts:Definition>Información acerca del esquema tributario de la Parte</ccts:Definition> <ccts:ObjectClass>Party Tax Scheme</ccts:ObjectClass> <ccts:AlternativeBusinessTerms>Esquema tributario de parte</ccts:AlternativeBusinessTerms> </ccts:Component> </xsd:documentation> </xsd:annotation> <xsd:sequence> <xsd:element ref="cbc:RegistrationName" minOccurs="0"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Party Tax Scheme. Registration_ Name. Name</ccts:DictionaryEntryName> <ccts:Definition>The official name of the party as registered with the relevant fiscal authority.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Party Tax Scheme</ccts:ObjectClass> <ccts:PropertyTermQualifier>Registration</ccts:PropertyTermQualifier> <ccts:PropertyTerm>Name</ccts:PropertyTerm> <ccts:RepresentationTerm>Name</ccts:RepresentationTerm> <ccts:DataType>Name. Type</ccts:DataType> <ccts:Examples>RegistrationName</ccts:Examples> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Party Tax Scheme. Registration_ Name. Name</ccts:DictionaryEntryName> <ccts:Definition>Nombre oficial según consta en el registro de la autoridad fiscal competente</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Party Tax Scheme</ccts:ObjectClass> <ccts:PropertyTermQualifier>Registration</ccts:PropertyTermQualifier> <ccts:PropertyTerm>Name</ccts:PropertyTerm> <ccts:RepresentationTerm>Name</ccts:RepresentationTerm> <ccts:DataType>Name. Type</ccts:DataType> <ccts:AlternativeBusinessTerms>Nombre oficial</ccts:AlternativeBusinessTerms> <ccts:Examples>RegistrationName</ccts:Examples> </ccts:Component> </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element ref="cbc:CompanyID" minOccurs="0"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Party Tax Scheme. Company Identifier. Identifier</ccts:DictionaryEntryName> <ccts:Definition>The identifier assigned for tax purposes to a party by the taxation authority.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Party Tax Scheme</ccts:ObjectClass> <ccts:PropertyTerm>Company Identifier</ccts:PropertyTerm> <ccts:RepresentationTerm>Identifier</ccts:RepresentationTerm> <ccts:DataType>Identifier. Type</ccts:DataType> <ccts:AlternativeBusinessTerms>VAT Number</ccts:AlternativeBusinessTerms> <ccts:Examples>CompanyID</ccts:Examples> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Party Tax Scheme. Company Identifier. Identifier</ccts:DictionaryEntryName> <ccts:Definition>Identificador asignado a la Parte por la autoridad fiscal a efectos tributarios</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Party Tax Scheme</ccts:ObjectClass> <ccts:PropertyTerm>Company Identifier</ccts:PropertyTerm> <ccts:RepresentationTerm>Identifier</ccts:RepresentationTerm> <ccts:DataType>Identifier. Type</ccts:DataType> <ccts:AlternativeBusinessTerms>ID de empresa</ccts:AlternativeBusinessTerms> <ccts:Examples>CompanyID</ccts:Examples> </ccts:Component> </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element ref="cbc:TaxLevelCode" minOccurs="0"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Party Tax Scheme. Tax Level Code. Code</ccts:DictionaryEntryName> <ccts:Definition>The section or role within the tax scheme that applies to the party.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Party Tax Scheme</ccts:ObjectClass> <ccts:PropertyTerm>Tax Level Code</ccts:PropertyTerm> <ccts:RepresentationTerm>Code</ccts:RepresentationTerm> <ccts:DataType>Code. Type</ccts:DataType> <ccts:Examples>TaxLevelCode</ccts:Examples> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Party Tax Scheme. Tax Level Code. Code</ccts:DictionaryEntryName> <ccts:Definition>Sección o papel especificado por el esquema tributario aplicable a la Parte</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Party Tax Scheme</ccts:ObjectClass> <ccts:PropertyTerm>Tax Level Code</ccts:PropertyTerm> <ccts:RepresentationTerm>Code</ccts:RepresentationTerm> <ccts:DataType>Code. Type</ccts:DataType> <ccts:AlternativeBusinessTerms>Código de nivel tributario</ccts:AlternativeBusinessTerms> <ccts:Examples>TaxLevelCode</ccts:Examples> </ccts:Component> </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element ref="cbc:ExemptionReasonCode" minOccurs="0"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Party Tax Scheme. Exemption Reason Code. Code</ccts:DictionaryEntryName> <ccts:Definition>A reason for a party's exemption from tax, expressed as a code.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Party Tax Scheme</ccts:ObjectClass> <ccts:PropertyTerm>Exemption Reason Code</ccts:PropertyTerm> <ccts:RepresentationTerm>Code</ccts:RepresentationTerm> <ccts:DataType>Code. Type</ccts:DataType> <ccts:Examples>ExemptionReasonCode</ccts:Examples> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Party Tax Scheme. Exemption Reason Code. Code</ccts:DictionaryEntryName> <ccts:Definition>Código que tipifica la razón o motivo por el que una Parte es exonerada del pago de tributos</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Party Tax Scheme</ccts:ObjectClass> <ccts:PropertyTerm>Exemption Reason Code</ccts:PropertyTerm> <ccts:RepresentationTerm>Code</ccts:RepresentationTerm> <ccts:DataType>Code. Type</ccts:DataType> <ccts:AlternativeBusinessTerms>Código de motivo de exención</ccts:AlternativeBusinessTerms> <ccts:Examples>ExemptionReasonCode</ccts:Examples> </ccts:Component> </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element ref="cbc:ExemptionReason" minOccurs="0"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Party Tax Scheme. Exemption_ Reason. Text</ccts:DictionaryEntryName> <ccts:Definition>A reason for a party's exemption from tax, expressed as text.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Party Tax Scheme</ccts:ObjectClass> <ccts:PropertyTermQualifier>Exemption</ccts:PropertyTermQualifier> <ccts:PropertyTerm>Reason</ccts:PropertyTerm> <ccts:RepresentationTerm>Text</ccts:RepresentationTerm> <ccts:DataType>Text. Type</ccts:DataType> <ccts:Examples>ExemptionReason</ccts:Examples> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Party Tax Scheme. Exemption_ Reason. Text</ccts:DictionaryEntryName> <ccts:Definition>Texto que describe la razón por la que una Parte es exonerada del pago de tributos</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Party Tax Scheme</ccts:ObjectClass> <ccts:PropertyTermQualifier>Exemption</ccts:PropertyTermQualifier> <ccts:PropertyTerm>Reason</ccts:PropertyTerm> <ccts:RepresentationTerm>Text</ccts:RepresentationTerm> <ccts:DataType>Text. Type</ccts:DataType> <ccts:AlternativeBusinessTerms>Motivo de exención</ccts:AlternativeBusinessTerms> <ccts:Examples>ExemptionReason</ccts:Examples> </ccts:Component> </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element ref="RegistrationAddress" minOccurs="0"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>ASBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Party Tax Scheme. Registration_ Address. Address</ccts:DictionaryEntryName> <ccts:Definition>An association to Registered Address (for tax purposes).</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Party Tax Scheme</ccts:ObjectClass> <ccts:PropertyTermQualifier>Registration</ccts:PropertyTermQualifier> <ccts:PropertyTerm>Address</ccts:PropertyTerm> <ccts:AssociatedObjectClass>Address</ccts:AssociatedObjectClass> <ccts:Examples>RegistrationAddress</ccts:Examples> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>ASBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Party Tax Scheme. Registration_ Address. Address</ccts:DictionaryEntryName> <ccts:Definition>Asociación con el Domicilio Social registrado (sólo a efectos fiscales)</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Party Tax Scheme</ccts:ObjectClass> <ccts:PropertyTermQualifier>Registration</ccts:PropertyTermQualifier> <ccts:PropertyTerm>Address</ccts:PropertyTerm> <ccts:AssociatedObjectClass>Address</ccts:AssociatedObjectClass> <ccts:AlternativeBusinessTerms>Domicilio social</ccts:AlternativeBusinessTerms> <ccts:Examples>RegistrationAddress</ccts:Examples> </ccts:Component> </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element ref="TaxScheme" minOccurs="1"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>ASBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Party Tax Scheme. Tax Scheme</ccts:DictionaryEntryName> <ccts:Definition>An association to Tax Scheme.</ccts:Definition> <ccts:Cardinality>1</ccts:Cardinality> <ccts:ObjectClass>Party Tax Scheme</ccts:ObjectClass> <ccts:PropertyTerm>Tax Scheme</ccts:PropertyTerm> <ccts:AssociatedObjectClass>Tax Scheme</ccts:AssociatedObjectClass> <ccts:Examples>TaxScheme</ccts:Examples> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>ASBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Party Tax Scheme. Tax Scheme</ccts:DictionaryEntryName> <ccts:Definition>Asociación con el Esquema Tributario.</ccts:Definition> <ccts:Cardinality>1</ccts:Cardinality> <ccts:ObjectClass>Party Tax Scheme</ccts:ObjectClass> <ccts:PropertyTerm>Tax Scheme</ccts:PropertyTerm> <ccts:AssociatedObjectClass>Tax Scheme</ccts:AssociatedObjectClass> <ccts:AlternativeBusinessTerms>Esquema tributario</ccts:AlternativeBusinessTerms> <ccts:Examples>TaxScheme</ccts:Examples> </ccts:Component> </xsd:documentation> </xsd:annotation> </xsd:element> </xsd:sequence> </xsd:complexType> |

Ministerio de Hacienda y Función Pública. Dirección General del Patrimonio del Estado.

Ministerio de Hacienda y Función Pública. Dirección General del Patrimonio del Estado.