| diagram |  |

||||

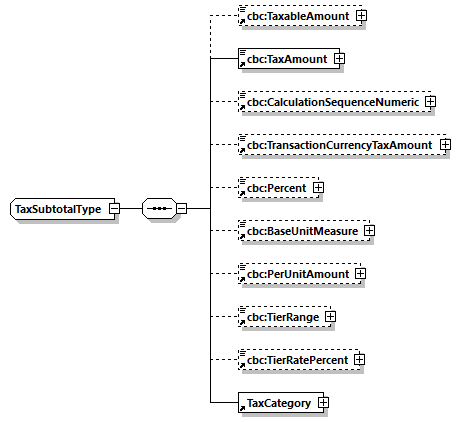

| namespace | urn:dgpe:names:draft:codice:schema:xsd:CommonAggregateComponents-2 | ||||

| children | TaxableAmount TaxAmount CalculationSequenceNumeric TransactionCurrencyTaxAmount Percent BaseUnitMeasure PerUnitAmount TierRange TierRatePercent TaxCategory | ||||

| used by |

|

||||

| annotation |

|

||||

| source | <xsd:complexType name="TaxSubtotalType"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>ABIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Details</ccts:DictionaryEntryName> <ccts:Definition>Information about the subtotal for a particular tax category within a tax scheme, such as standard rate within VAT.</ccts:Definition> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>ABIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Details</ccts:DictionaryEntryName> <ccts:Definition>Información acerca del subtotal de una Categoría tributaria dentro de un Tipo de tributo, como por ejempo el Porcentaje estándar dentro de la categoría IVA</ccts:Definition> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:AlternativeBusinessTerms>Subtotal Impositivo</ccts:AlternativeBusinessTerms> </ccts:Component> </xsd:documentation> </xsd:annotation> <xsd:sequence> <xsd:element ref="cbc:TaxableAmount" minOccurs="0"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Taxable_ Amount. Amount</ccts:DictionaryEntryName> <ccts:Definition>The net amount to which the tax percent (rate) is applied to calculate the tax amount.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTermQualifier>Taxable</ccts:PropertyTermQualifier> <ccts:PropertyTerm>Amount</ccts:PropertyTerm> <ccts:RepresentationTerm>Amount</ccts:RepresentationTerm> <ccts:DataType>Amount. Type</ccts:DataType> <ccts:Examples>TaxableAmount</ccts:Examples> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Taxable_ Amount. Amount</ccts:DictionaryEntryName> <ccts:Definition>Cantidad neta a la que se aplica el Tipo impositivo (porcentaje impuesto) para calcular la Cuota</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTermQualifier>Taxable</ccts:PropertyTermQualifier> <ccts:PropertyTerm>Amount</ccts:PropertyTerm> <ccts:RepresentationTerm>Amount</ccts:RepresentationTerm> <ccts:DataType>Amount. Type</ccts:DataType> <ccts:AlternativeBusinessTerms>Base imponible</ccts:AlternativeBusinessTerms> <ccts:Examples>TaxableAmount</ccts:Examples> </ccts:Component> </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element ref="cbc:TaxAmount" minOccurs="1"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Tax Amount. Amount</ccts:DictionaryEntryName> <ccts:Definition>The amount of tax stated explicitly.</ccts:Definition> <ccts:Cardinality>1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Tax Amount</ccts:PropertyTerm> <ccts:RepresentationTerm>Amount</ccts:RepresentationTerm> <ccts:DataType>Amount. Type</ccts:DataType> <ccts:Examples>TaxAmount</ccts:Examples> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Tax Amount. Amount</ccts:DictionaryEntryName> <ccts:Definition>Importe explícito a tributar.</ccts:Definition> <ccts:Cardinality>1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Tax Amount</ccts:PropertyTerm> <ccts:RepresentationTerm>Amount</ccts:RepresentationTerm> <ccts:DataType>Amount. Type</ccts:DataType> <ccts:AlternativeBusinessTerms>Cuota</ccts:AlternativeBusinessTerms> <ccts:Examples>TaxAmount</ccts:Examples> </ccts:Component> </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element ref="cbc:CalculationSequenceNumeric" minOccurs="0"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Calculation Sequence. Numeric</ccts:DictionaryEntryName> <ccts:Definition>Identifies the numerical order sequence in which taxes are applied when multiple taxes are attracted. If all taxes apply to the same taxable amount, CalculationSequenceNumeric will be '1' for all taxes.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Calculation Sequence</ccts:PropertyTerm> <ccts:RepresentationTerm>Numeric</ccts:RepresentationTerm> <ccts:DataType>Numeric. Type</ccts:DataType> <ccts:Examples>CalculationSequenceNumeric</ccts:Examples> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Calculation Sequence. Numeric</ccts:DictionaryEntryName> <ccts:Definition>Identifica la secuencia numérica ordenada en la que se aplican los tributos en el caso de múltiples tributos. Si todos los tributos se refieren a la misma Base Imponible, la Secuencia de cálculos será “1” para todos los tributos.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Calculation Sequence</ccts:PropertyTerm> <ccts:RepresentationTerm>Numeric</ccts:RepresentationTerm> <ccts:DataType>Numeric. Type</ccts:DataType> <ccts:AlternativeBusinessTerms>Secuencia de cálculos</ccts:AlternativeBusinessTerms> <ccts:Examples>CalculationSequenceNumeric</ccts:Examples> </ccts:Component> </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element ref="cbc:TransactionCurrencyTaxAmount" minOccurs="0"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Transaction Currency_ Tax Amount. Amount</ccts:DictionaryEntryName> <ccts:Definition>The tax amount, expressed in the currency used for invoicing.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTermQualifier>Transaction Currency</ccts:PropertyTermQualifier> <ccts:PropertyTerm>Tax Amount</ccts:PropertyTerm> <ccts:RepresentationTerm>Amount</ccts:RepresentationTerm> <ccts:DataType>Amount. Type</ccts:DataType> <ccts:Examples>TransactionCurrencyTaxAmount</ccts:Examples> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Transaction Currency_ Tax Amount. Amount</ccts:DictionaryEntryName> <ccts:Definition>Cuota expresada en la moneda utilizada para facturar.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTermQualifier>Transaction Currency</ccts:PropertyTermQualifier> <ccts:PropertyTerm>Tax Amount</ccts:PropertyTerm> <ccts:RepresentationTerm>Amount</ccts:RepresentationTerm> <ccts:DataType>Amount. Type</ccts:DataType> <ccts:AlternativeBusinessTerms>Cuota en la moneda de transacción</ccts:AlternativeBusinessTerms> <ccts:Examples>TransactionCurrencyTaxAmount</ccts:Examples> </ccts:Component> </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element ref="cbc:Percent" minOccurs="0"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Percent</ccts:DictionaryEntryName> <ccts:Definition>The tax rate for the category, expressed as a percentage.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Percent</ccts:PropertyTerm> <ccts:RepresentationTerm>Percent</ccts:RepresentationTerm> <ccts:DataType>Percent. Type</ccts:DataType> <ccts:Examples>Percent</ccts:Examples> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Percent</ccts:DictionaryEntryName> <ccts:Definition>Porcentaje que se aplica a la Base Imponible utilizado para calcular la Cuota</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Percent</ccts:PropertyTerm> <ccts:RepresentationTerm>Percent</ccts:RepresentationTerm> <ccts:DataType>Percent. Type</ccts:DataType> <ccts:AlternativeBusinessTerms>Porcentaje</ccts:AlternativeBusinessTerms> <ccts:Examples>Percent</ccts:Examples> </ccts:Component> </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element ref="cbc:BaseUnitMeasure" minOccurs="0"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Base Unit Measure. Measure</ccts:DictionaryEntryName> <ccts:Definition>Where a tax is applied at a certain rate per unit, the measure of units on which the tax calculation is based.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Base Unit Measure</ccts:PropertyTerm> <ccts:RepresentationTerm>Measure</ccts:RepresentationTerm> <ccts:DataType>Measure. Type</ccts:DataType> <ccts:Examples>BaseUnitMeasure</ccts:Examples> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Base Unit Measure. Measure</ccts:DictionaryEntryName> <ccts:Definition>Número de unidades a partir del cual se calcula el tributo, cuando éste se aplica basándose en un determinado porcentaje por unidad</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Base Unit Measure</ccts:PropertyTerm> <ccts:RepresentationTerm>Measure</ccts:RepresentationTerm> <ccts:DataType>Measure. Type</ccts:DataType> <ccts:AlternativeBusinessTerms>Unidades base</ccts:AlternativeBusinessTerms> <ccts:Examples>BaseUnitMeasure</ccts:Examples> </ccts:Component> </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element ref="cbc:PerUnitAmount" minOccurs="0"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Per Unit_ Amount. Amount</ccts:DictionaryEntryName> <ccts:Definition>Where a tax is applied at a certain rate per unit, the rate per unit applied.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTermQualifier>Per Unit</ccts:PropertyTermQualifier> <ccts:PropertyTerm>Amount</ccts:PropertyTerm> <ccts:RepresentationTerm>Amount</ccts:RepresentationTerm> <ccts:DataType>Amount. Type</ccts:DataType> <ccts:Examples>PerUnitAmount</ccts:Examples> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Per Unit_ Amount. Amount</ccts:DictionaryEntryName> <ccts:Definition>Importe por unidad aplicado, en el caso de que el tributo se base en un determinado porcentaje por unidad</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTermQualifier>Per Unit</ccts:PropertyTermQualifier> <ccts:PropertyTerm>Amount</ccts:PropertyTerm> <ccts:RepresentationTerm>Amount</ccts:RepresentationTerm> <ccts:DataType>Amount. Type</ccts:DataType> <ccts:AlternativeBusinessTerms>Importe unitario</ccts:AlternativeBusinessTerms> <ccts:Examples>PerUnitAmount</ccts:Examples> </ccts:Component> </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element ref="cbc:TierRange" minOccurs="0"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Tier Range. Text</ccts:DictionaryEntryName> <ccts:Definition>Where a tax is tiered, the range of tiers applied in the calculation of the tax subtotal for the tax category.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Tier Range</ccts:PropertyTerm> <ccts:RepresentationTerm>Text</ccts:RepresentationTerm> <ccts:DataType>Text. Type</ccts:DataType> <ccts:Examples>TierRange</ccts:Examples> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Tier Range. Text</ccts:DictionaryEntryName> <ccts:Definition>Rango de niveles aplicable en el cálculo del Subtotal de esta categoría, en el caso de que el tributo esté subdividido en niveles</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Tier Range</ccts:PropertyTerm> <ccts:RepresentationTerm>Text</ccts:RepresentationTerm> <ccts:DataType>Text. Type</ccts:DataType> <ccts:AlternativeBusinessTerms>Rango de niveles</ccts:AlternativeBusinessTerms> <ccts:Examples>TierRange</ccts:Examples> </ccts:Component> </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element ref="cbc:TierRatePercent" minOccurs="0"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Tier Rate. Percent</ccts:DictionaryEntryName> <ccts:Definition>Where a tax is tiered, the rate of tax applied to the range of tiers in the calculation of the tax subtotal for the tax category.</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Tier Rate</ccts:PropertyTerm> <ccts:RepresentationTerm>Percent</ccts:RepresentationTerm> <ccts:DataType>Percent. Type</ccts:DataType> <ccts:Examples>TierRatePercent</ccts:Examples> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>BBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Tier Rate. Percent</ccts:DictionaryEntryName> <ccts:Definition>Porcentaje del tributo aplicable al rango de niveles para calcular el Subtotal de esta categoría, en el caso de que el tributo esté subdividido en niveles</ccts:Definition> <ccts:Cardinality>0..1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Tier Rate</ccts:PropertyTerm> <ccts:RepresentationTerm>Percent</ccts:RepresentationTerm> <ccts:DataType>Percent. Type</ccts:DataType> <ccts:AlternativeBusinessTerms>Porcentaje del rango de niveles</ccts:AlternativeBusinessTerms> <ccts:Examples>TierRatePercent</ccts:Examples> </ccts:Component> </xsd:documentation> </xsd:annotation> </xsd:element> <xsd:element ref="TaxCategory" minOccurs="1"> <xsd:annotation> <xsd:documentation xml:lang="en"> <ccts:Component> <ccts:ComponentType>ASBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Tax Category</ccts:DictionaryEntryName> <ccts:Definition>An association to Tax Category.</ccts:Definition> <ccts:Cardinality>1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Tax Category</ccts:PropertyTerm> <ccts:AssociatedObjectClass>Tax Category</ccts:AssociatedObjectClass> <ccts:Examples>TaxCategory</ccts:Examples> </ccts:Component> </xsd:documentation> <xsd:documentation xml:lang="es"> <ccts:Component> <ccts:ComponentType>ASBIE</ccts:ComponentType> <ccts:DictionaryEntryName>Tax Subtotal. Tax Category</ccts:DictionaryEntryName> <ccts:Definition>Asociación con una Categoria Tributaria</ccts:Definition> <ccts:Cardinality>1</ccts:Cardinality> <ccts:ObjectClass>Tax Subtotal</ccts:ObjectClass> <ccts:PropertyTerm>Tax Category</ccts:PropertyTerm> <ccts:AssociatedObjectClass>Tax Category</ccts:AssociatedObjectClass> <ccts:AlternativeBusinessTerms>Categoría tributaria</ccts:AlternativeBusinessTerms> <ccts:Examples>TaxCategory</ccts:Examples> </ccts:Component> </xsd:documentation> </xsd:annotation> </xsd:element> </xsd:sequence> </xsd:complexType> |

Ministerio de Hacienda y Función Pública. Dirección General del Patrimonio del Estado.

Ministerio de Hacienda y Función Pública. Dirección General del Patrimonio del Estado.